Latest From Blog

-

May 23, 2023

May 23, 20237 Tips For Making Money Online From Home

Making money online from home is something most everyone can do. Click here to find out some ways you can drum up cash.

Read More >> -

March 30, 2023

March 30, 2023How Do I Apply For An Installment Loan Online?

Considering an installment loan online? Here's how you can apply with Missouri Title Loans, Inc. right now!

Read More >> -

August 20, 2021

August 20, 20216 Things You Should Know about Missouri Title Loans, Inc.

If you're considering the possibility of applying for title loans in Missouri, here's what you need to know about Missouri Title Loans, Inc.

Read More >> -

April 14, 2022

April 14, 2022How To Get A Title For A Car In Missouri

How do you get a replacement title for car? Discover the exact forms that you need to fill in in this post.

Read More >> -

January 9, 2026

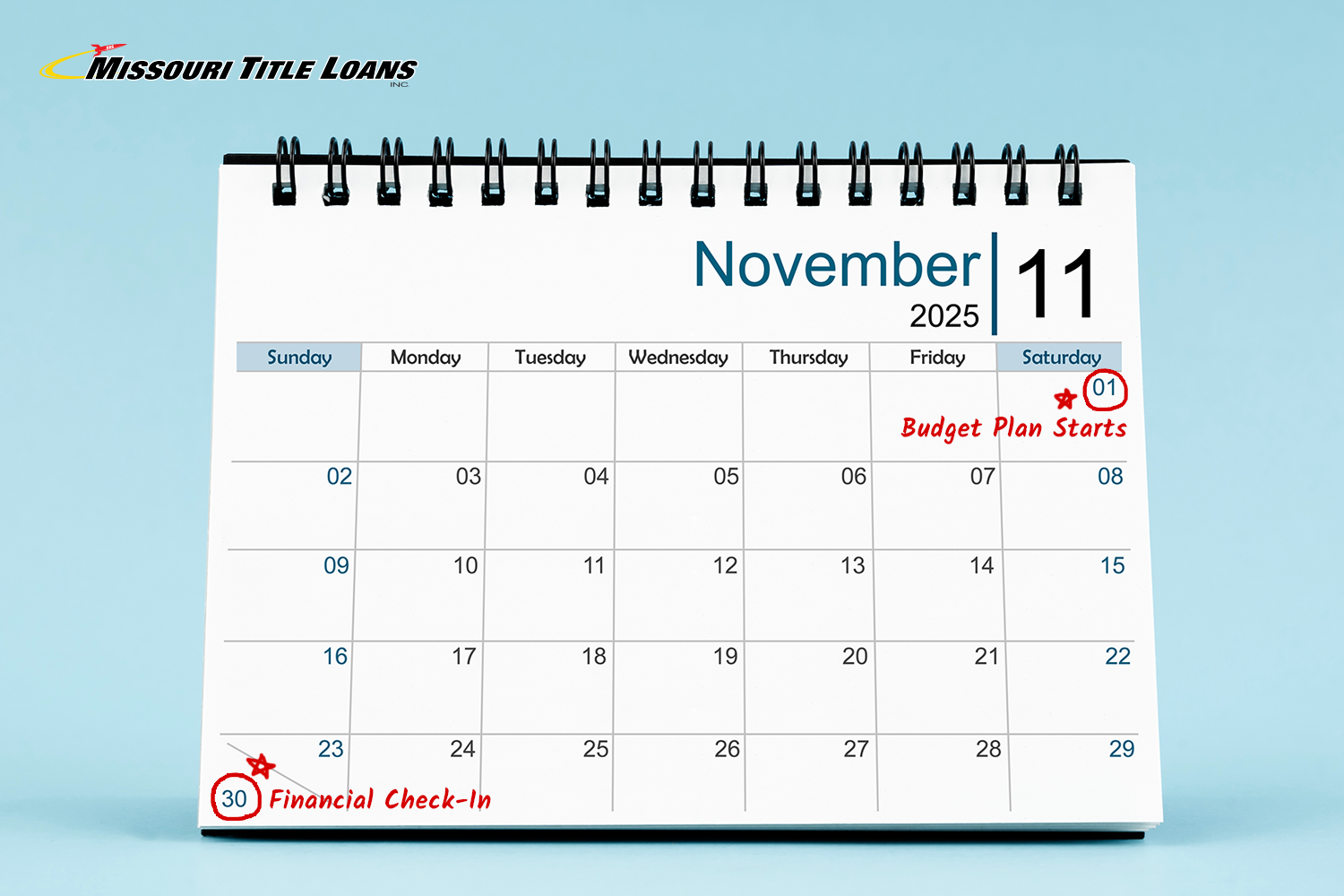

January 9, 2026From Borrowing To Budgeting: A 30-Day Plan After Getting A Title Loan In Missouri

Did you borrow a title loan but need help with repayment? Discover how to pay back what you owe with our 30-day smart title loan repayment plan!

Read More >> -

November 21, 2025

November 21, 20255 Myths About Personal Loans & How To Get Cash In Missouri

Have you avoided personal loans because of misconceptions? Learn about personal loan myths and how these fast cash loans can help you!

Read More >> -

October 20, 2025

October 20, 2025Title Loans For First-Time Borrowers In Missouri – What To Expect

Getting a title loan for the first-time? Learn everything you need to know about title loans, including the requirements, the approval process, how the value is determined, etc.

Read More >> -

September 15, 2025

September 15, 2025Top 5 Reasons People In Missouri Use Title Loans

Title loans are a popular emergency financing option in Missouri. Learn the benefits of title loans that make them appealing, including loan amounts, requirements, and the simple process.

Read More >> -

August 11, 2025

August 11, 2025Smart Ways To Use A Title Loan In Missouri To Manage Emergency Expenses

Need title loans for emergency expenses? Learn how to use a title loan wisely for emergencies like medical bills, auto repairs, and overdue expenses!

Read More >> -

July 8, 2025

July 8, 2025How To Recover After A Vehicle Repossession In Missouri

Learn what to do after a car repo in Missouri, including how to get your car back. Afford car payments and avoid repossession with loans from Missouri Title Loans, Inc.

Read More >>